The SEC filed a lawsuit against Elon Musk on Tuesday, alleging the billionaire committed securities fraud in 2022 by failing to disclose he had amassed an active stake in Twitter, a secrecy that allowed him to buy shares at “artificially low prices.”

Musk, who is also CEO of Tesla and SpaceX, purchased Twitter for $44 billion in late 2022 and changed the name to X the following year. Prior to the acquisition, he’d built up a position in the company of greater than 5%, which would’ve requ

ired disclosing his holdings to the public within 10 calendar days of reaching that threshold.According to the SEC’s civil complaint,

filed in U.S. District Court in Washington, D.C., Musk was more than 10 days late in reporting that material information, “allowing him to underpay by at least $150 million for shares he purchased after his financial beneficial ownership report was due.” Investors may have bid up the stock had they known about Musk’s purchases and interest in the company.

The SEC had been investigating whether Musk, or anyone else working with him, committed securities fraud in 2022 around the Twitter disclosures. Musk said in a post on X last month that the SEC issued a “settlement demand,” pressuring him to agree to a deal, including a fine within 48 hours or “face charges on numerous counts” regarding the purchase of shares.

More from CNBC

- Meta announces 5% cuts in preparation for ‘intense year’ — read the internal memo

- CFPB sues Capital One for ‘cheating’ customers out of over $2 billion in interest

- Intel to spin off venture capital arm as chipmaker continues to restructure

Musk’s lawyer, Alex Spiro, said in an emailed statement on Tuesday that the SEC’s action is an admission that “they cannot bring an actual case.” Spiro, a partner at Quinn Emanuel, added that Musk “has done nothing wrong” and called the suit a “sham” and the result of a “multi-year campaign of harassment,” culminating in a “single-count ticky tak complaint.”

An SEC spokesperson declined to comment “beyond the litigation release and the complaint, which is, literally, an actual case brought by the SEC.”

In a post on X after the complaint was filed, Musk called the SEC a “totally broken organization” that’s focusing “on s— like this when there are so many actual crimes that go unpunished.”

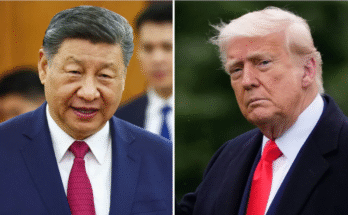

Musk is just a week away from having unparalleled influence in the White House, as President-elect Donald Trump’s second term begins on Jan. 20. Musk, who was a major financial backer of Trump in the latter stages of the campaign, is poised to lead an advisory group that will focus in part on reducing regulations, including those that affect Musk’s various companies.

In July, Trump vowed to fire SEC chairman Gary Gensler, whose term began in 2021 under President Joe Biden. After Trump’s election victory, Gensler announced that he would be resigning from his post instead. Trump plans to nominate Paul Atkins as the next chair of the SEC.

In a separate civil lawsuit concerning the Twitter deal, the Oklahoma Firefighters Pension and Retirement System sued Musk in 2022, accusing him of deliberately concealing his progressive investments in the social network and intent to buy the company. The pension fund’s attorneys argued that Musk, by failing to clearly disclose his investments, had influenced other shareholders’ decisions and put them at a disadvantage.

That case, Rasella v. Musk, was filed in April 2022 in a federal court in the Southern District of New York.

The SEC said in Tuesday’s complaint that Musk crossed the 5

% ownership mark in his Twitter ownership in March 2022, and would have been required to disclose his holdings by March 24.

“On April 4, 2022, eleven days after a report was due, Musk finally publicly disclosed his beneficial ownership in a report with the SEC, disclosing that he had acquired over nine percent of Twitter’s outstanding stock,” the complaint says. “That day, Twitter’s stock price increased more than 27% over its previous day’s closing price.”